When I saw how self storage worked, I fell in love with it.

In the mid-1990’s I was a commercial real estate professional. I sold all kinds of investment real estate but I also had a company that focused on office building sales, leasing, and management.

Our record was good. We worked with investors to reposition office product then sell it for our clients.

With that experience and knowledge, I went out for the first time to show self storage to an Acquisition Director for a REIT in our market.

I wore a suit and tie every day back then. I had a CCIM designation. I knew how to generate IRR calculation (Internal Rate of Returns). I used Argus on a regular basis (institutional grade financial analysis software for investment real estate). I felt quite superior to anyone who might be in this self storage thing.

Self Storage looked pretty ugly, simple, and beneath what someone of my pedigree and industry knowledge would be involved with. But being an agent and living on commissions, it was hard to say no.

Here was a chance to sell something to someone who obviously had money and sounded very anxious to buy. I had never been involved in a self storage transaction. I didn’t know anyone who had ever sold a “mini storage” facility (I was quickly told by this REIT Director it was not “mini storage” it was “self storage”).

Over the course of working with this person, I saw how they valued self storage, how the product performed, and the fundamentals of it.

I was blown away.

It sure didn’t take me long to see that this product could outperform the office product I was involved with hands down.

I saw that the capital expenses below the NOI line (Net Operating Income) were minimal in self storage. In my office management business, we could spend $20 per square foot or more to put a new tenant in. We used to budget over $5 per square foot just to release a tenant.

Self Storage had none of that. No toilets, appliances, carpet. There was only a concrete floor and a steel wall generating income almost at the levels of the office buildings we managed.

I thought that was the real benefits of this product type and it drove me into this business.

That alone is good and a big reason why self storage is the absolute best product there is for the small investor (or any investor for that matter).

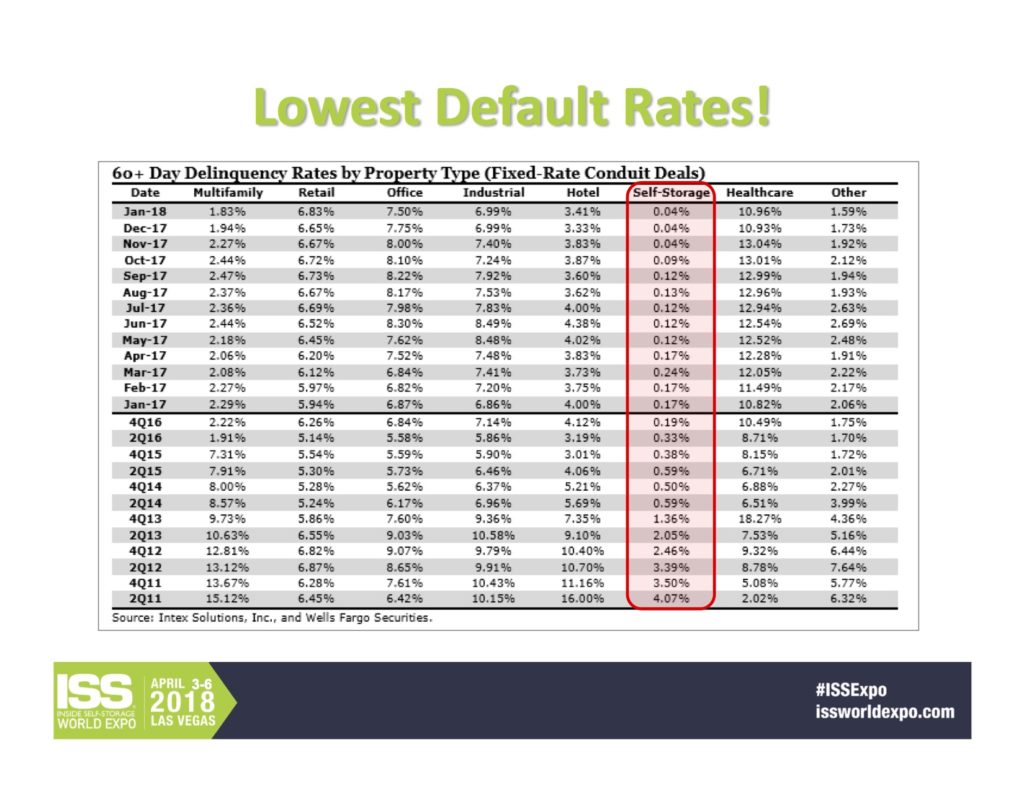

Incomes can rise and are not tied into to lease terms. Net cash flows can be projected very accurately. Self storage also has the lowest default rate of any type if investment real estate.

Then a big recession hit.

I (as well as many others including Wall Street) saw perhaps the best feature of self storage there is…. how well it performed in an economic downturn.

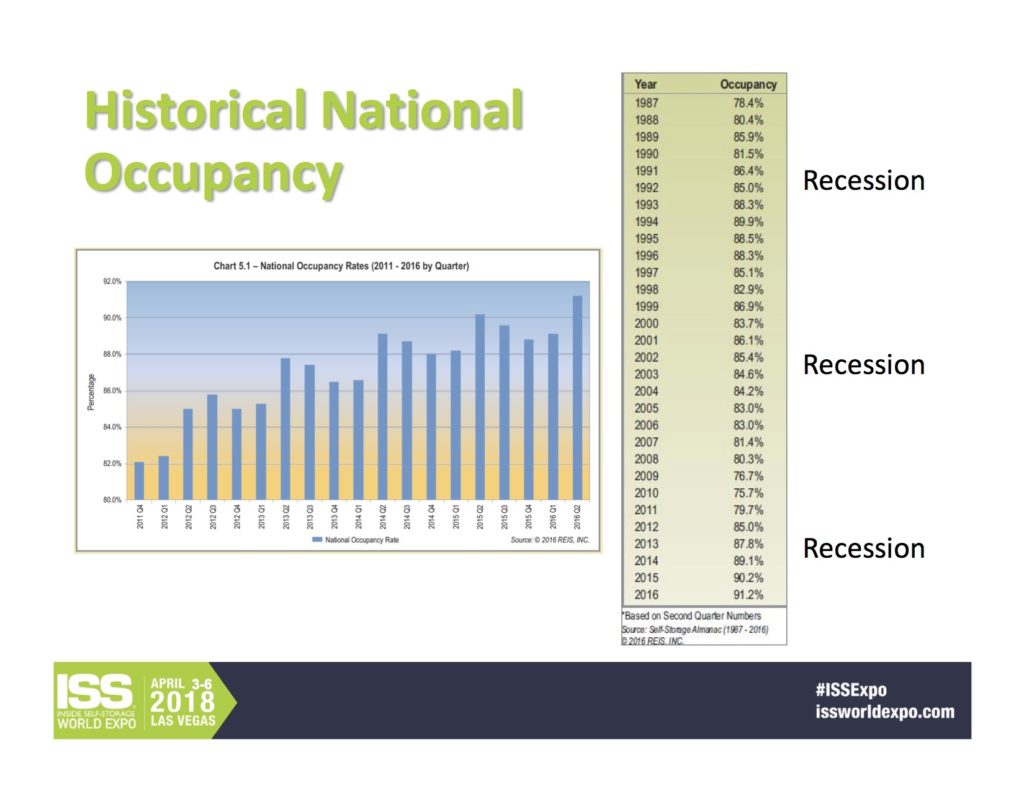

I had recently started back in the business in 2008 (after selling a small portfolio) when the economic world turned upside down. The “recession” hit. When we closed on a property that year, we had 88% occupancy which was higher than the national average at the time (see chart below).

Then over the next couple of years, our occupancy went down to between 82% and 83%.

Other real estate sectors lost considerably more than 6% occupancy.

We felt that but I also had a record storage business, a B2B business, and it lost over 20% of the business.

I am focusing on this now because the next phase of the economic cycle that will hit us in most markets is a recession. You need to understand this as you put self storge into service now so you can adjust how you do business.

Let’s look at self storage in a recession.

My first suggestion is to underwrite at lower occupancy rates than you currently have.

Most projects we look at have 90% plus occupancy rates. I know it takes something to do this now but I recommend underwriting them at 85%.

Another feature of self storage in a recession is collections.

We had to work much harder on collections and to keep the economic occupancy only slightly below the physical occupancy.

We all have those customers who are always late and locked out of their units. We schedule the auctions and then they rush to catch up to stay out of the auction, then slide back into late status.

We began to notice that these guys started to let their units go to auction.

We had to offer more incentives to get new customers in.

But all in all especially compared to other types of real estate, self storage held its own.

Banks noticed this as well as other real estate investors who had previously looked at self storage with the same attitude I had in the beginning.

Here is a slide showing self storage having the lowest foreclosure rate of any type of real estate investment.

If you are in the business of raising money for investments, you have a great story. I say now is the time to start positioning yourself as the expert in self storage in your market. Investors love to find a place they can put money and feel safe. There is no better place than self storage in an economic downturn.

That doesn’t mean you have to wait until a recession, but be smart and strategic now so you are ready for the turn. Help keep your and your investors safe by being in self storage. You will create True Wealth and a fulfilling career in the self storage business.

Hello,

Yes, we are syndicators and have closed on two self-storage deals, and working on our third deal in Morganton, NC. We are super excited about this asset class and the potential returns it’s going to bring to our team and investors. What states or towns are you investing in? Let’s connect through email. Talk to you soon. – Madeline Yau

Utah, AZ and SC right now. Sold two brands mostly in south east.