Over 90% of all business that are started today will fail within ten years.

And don’t fool yourself, self storage is a business. Yes, it is real estate play but it’s also a business. In many ways, we are double exposed. We must have real estate knowledge as well as business training to succeed.

Warren Buffett says “The language of business is accounting.”

For a guy like me that is a scary thought.

I have had no formal training in business and accounting. Because I am using other people’s money to grow a self storage business, I got very clear I had better learn.

It really doesn’t matter if you are using your money, your family’s money, or investors’ money. It’s your responsibility to learn the language of business.

Every game, every industry, and every investment sector has its own language. And again, the language of business is accounting.

Accountants have a strange language indeed. Often they have multiple words for the same thing. And like lawyers, they complicate the language to create specialization so they are needed.

Job security I guess.

My first goal was to find a way to translate their language to something that I could understand. I found training through Keith Cunningham’s financial literacy series and I highly recommend it if you want to go further.

Before we start translating their language, let’s do an overview.

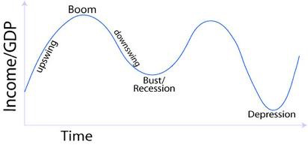

A business cycle last approximately ten years.

On average, from the bottom of the wave to the top is around ten years. Sometimes longer, sometimes shorter, but the consensus is approximately ten years.

Most business owners ride the wave up in good times. They make money and things are great. We have been in an upward wave since around 2010.

Then as the cycle goes down they give back all the money they have made.

How was 2008 for you?

I have found it is easy to make money. Just start a business or buy a self storage facility as the tide is going up.

The real trick, the real skill is Keeping The Money as the tide goes out.

Here are three statistics:

- 90% of all business fail within 10 years.

- The average swing from the bottom of an economic cycle to the top is ten years.

- 90% of all business owners don’t read, or don’t know how to read a financial statement.

I am not sure, but I bet there is a correlation between these three statistics.

Let’s take on that there is a correlation and we are going to be part of the other 10%.

So if you want to beat the odds, let’s figure out how to read a financial statement. I mean really be able to look at the numbers of a company, any company, then know what to do.

Why?

To be able to create dials and levers to pull and move so you can keep the money in the downtimes that you made during the good times.

I am not a specialist in reading financial statements, and if you are trained in accounting, please don’t laugh.

For me to learn, I had to take what appeared to be complicated and dumb it down so I could get my mind around it. And this is what I have figured out so far.

It turns out that business is a game.

I often thank our investors for allowing us to play the self storage game. I am more empowered playing a game than I am running a business, so that’s my approach.

Yes, business is a game and money is the points. And like any game, there is a scoreboard and the game has its own language.

The scorekeepers in the game of business are the accountants and their language is the businesses language. Once I began to figure out how to translate their language into storage-speak then I could begin to understand the scorecards.

It turns out there are three main scorecards they use to score business.

The first main scorecard is a weird one indeed.

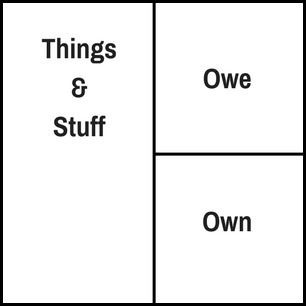

It turns out that every business has Things & Stuff. That goes on the first scorecard.

The first scorecard is broken into three basic parts.

So what are some of the Things & Stuff a self storage business would own?

The buildings are Things, right? So is the fencing around the facilities. The computers are also Things.

What else?

Well, it turns out the scorekeepers call our money Stuff as well. If you have $35,000 in your bank account, that is Stuff that goes on this scorecard.

On the first of the month (or on the anniversary date if that is how you are set up) your customers will owe you money. That is Stuff as well. The scorekeepers call that stuff “Account Receivables.”

All the retail things we sell in our facilities that I go on about all the time – turns out that is Stuff too. That also shows up on this scorecard.

In accountant-speak, they say there are four major parts of “Things and Stuff” that they measure.

- Cash

- Accounts Receivable

- Inventory

- PP&E: property, plant, and equipment.

All I know is that all the Things & Stuff of a self storage facility will fall into one of those four categories. I really don’t care which one they’re in. To me, it’s all Things & Stuff.

I finally figured out that a business will either Own or Owe on their Things & Stuff.

What would you Owe in your business?

Well, you owe taxes, right? You also owe the light bill and the insurance bill. You owe the employment taxes for your manager as well as their salary when due.

That is some of the things we owe. The score keepers call it Accounts Payable (A/P).

There are also some long-term things we Owe as well, right? Like loans with the bank for the real estate. The scorekeepers don’t call loans “A/P” for some reason, they call those Owes “Long Term Liabilities.” The difference is if there’s interest. It is called “Long Term Liabilities” if there is interest involved and if there is no interest it is “A/P.”

To me, it doesn’t matter. It’s just stuff I owe.

And yes, a business will Own monetary things as well. It gets a little weird here.

The scorekeepers say we Own our (1) investment (the money we used to invest in and buy or start the facility) and we Own (2) our profits (they call that “Earnings”). So according to them, we Own our investment and earnings. It is a good thing we own our profits. I guess in some countries and in other times, we wouldn’t necessarily own our profits.

Now what is cool is that in the above figure, the “Things & Stuff” side equals the “Owe” and “Own” Side.

I think that’s cool.

I guess that’s why they call it a Balance Sheet. I would much rather call it the Things & Stuff Scorecard.

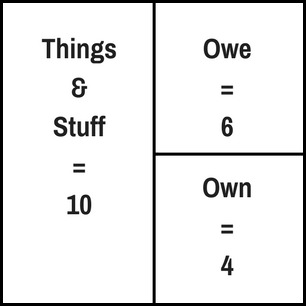

Now here is where it starts to make sense to me. Let’s say your Things & Stuff equals 10.

What you owe is 8. What is the amount of Own?

That’s right, it is 2.

You are now already way ahead of many business owners.

Now the scorekeepers call Things & Stuff “Assets”. They call Owe “Liabilities” and they call Own “Equity,” but I like mine better. Makes more sense to me.

They call this scorecard a Balance Sheet. I like to call it Scorecard 1.

This scorecard is like a snapshot. It gives the score of the Things & Stuff in a moment in time. Theoretically, one minute later it has changed. It is just a score at a given time, like 12-31-2016.

Now one more thing for today about the Own things. Remember, you Own your profits, right? Well it turns out that there are two types of profits you Own. There are the profits you Own from the second scorecard we will talk about next week. For now, we will just say it is the profits from a given period of time that ends on the day the snapshot was taken for Scorecard 1. But there is also another kind of profit, or earnings, on this part of the scorecard. It is all the earnings you have made since the start of the company that you have not paid yourself or your investors.

If you pay yourself or your investors some of the profits, the scorekeepers call that “Dividends.” I like to call it profit I paid out.

If you decide not to pay it out and keep it in the company it’s called “Retained Earnings.”

Pretty cool isn’t it? You now have the basic understanding of a balance sheet. I bet you can now start to look at a balance sheet (scorecard 1) and get more information about a company than you did before this episode.

Let’s look at something.

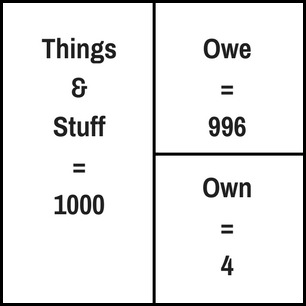

Both companies below have earnings (or profit) of 4 below, but are these two companies alike?

Company 1

Company 2

No, they are not alike. Why?

Are their “Assets” and “Liabilities” alike? Which company would you rather invest in or buy?

Company 1 can turn a 40% profit on their assets. Company 2 can turn less than one-half of one percent profits on their assets. But yet, I bet company 2’s assets are worth more than company 1.

Which company is worth more?

Which company is better run?

Are you beginning to see things now about a company from their Balance Sheet you couldn’t before?

You are beginning to translate accountant’s language into understandable language. Said another way, you are turning numbers into words and a story simply from looking at a scorecard.

Next week we’ll look at the other big scorecard and the surprise I learned about it.

Then we will put all three scorecards together and show how they are connected. Once you see that the complete story of a company starts to emerge.

Once you can get the story from the numbers, you can make intelligent decisions about where to push and where to pull on a company, and how each movement will turn into more numbers.

You will be able to turn numbers into a story and take action and turn it back into numbers.

That is what the 10% do.