We are back to where we started as we begin the end of this series on self storage finances. Hopefully, you are starting to understand what the financial reports for your business are telling you. Or the reports your soon to be business are generating.

I realized I didn’t need to be a financial wizard for the numbers tell me a story or give me information.

In fact, I’m probably better off not being a financial wizard. I say its good not to be over encumbered with a lot of intelligence.

I just had to learn how to begin to translate the language of accounting into something I could understand.

As a self storage owner, or soon to be owner, it is important for you to do so as well.

We are lucky that we’re in self storage. It generates more operating cash per employee than any business I have seen. We are generating about $250,000 gross operating cash per employee.

That wasn’t always the case, but by watching the story generated by the numbers we saw that we could improve that metric.

Here are the three statistics we have been discussing:

- 90% of all business fail within 10 years.

- The average swing from the bottom of an economic cycle to the top is ten years.

- 90% of all business owners don’t read, or don’t know how to read, a financial statement.

This series was designed to give you a translation into the weird world of accounting as I have begun to learn it. I hope it has helped.

Now, let’s put the scorecards together and see what happens.

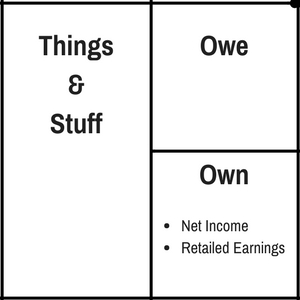

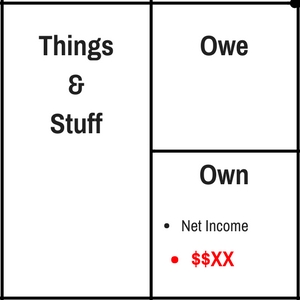

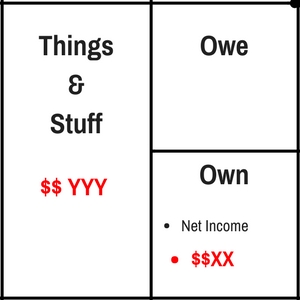

Remember the first scorecard we discussed? Scorecard 1? The one the scorekeepers (accountants) call a Balance Sheet?

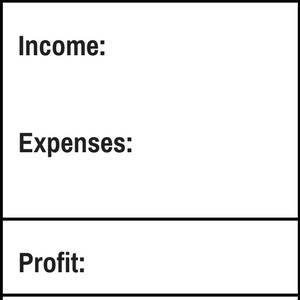

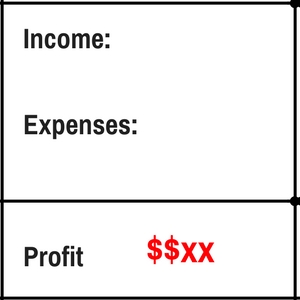

And remember Scorecard 2? The one accountants call it a P&L (profit and loss) or an Income Statement. There are lots of words for the same thing which always is fun as we try to translate a foreign language.

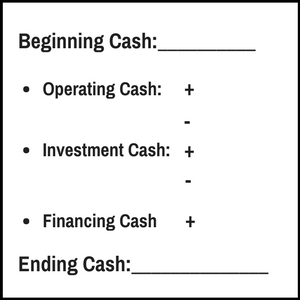

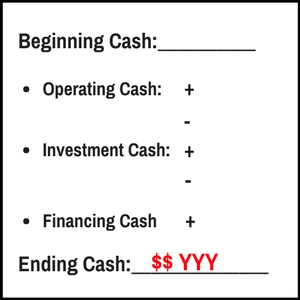

And finally Scorecard 3, the only scorecard that truly deals with actual facts? In other words – cash.

The bottom line of Scorecard 2 is the one every owner loves to look at, cry over or get excited about. That number is the theory of the profits made in that month. Or that year if that is the time period we’re looking at.

Whatever that number is, you’ll also see it here on Scorecard 1, the Balance Sheet.

Remember the amount of cash left over on Scorecard 3?

That shows up here on Scorecard 1.

You could say that Scorecard 1 is the snapshot of 11:59 PM on the last day of the month.

Scorecard 2 is the movie of the transactions that month (or whatever time period you are looking at), turning the activity into numbers. This scorecard is not designed to tell you how much money you made, it is designed to tell you in theory, what your profits were. Scorekeepers and the government are more interested in profits made than money made.

Business owners are more interested in money made than profits.

Scorecard 3 is a movie of the same time period. The action of the movie is all the transactions that happen. These transactions can involve customers and vendors or banks and investors. Scorecard 3 takes all those actions and turns them into numbers that track the actual cash.

Here is what I learned as I began to really translate this strange language into something I can understand.

IF YOU START FOCUSING ON CASH AND NOT EARNINGS OR PROFIT, YOU WILL TRANSFORM YOUR BUSINESS.

Tony Robbins says the quality of your life or business is a function of the questions you ask.

I suggest changing the question, “How can we turn a bigger profit?”

We now have a never ending quest. It is an exploration, a deep dive into a new world. From the translation of the weird language of accounting, we are now asking questions like:

How can we turn our profits into operating cash?

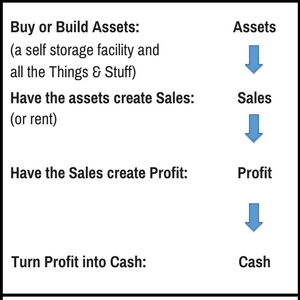

I have seen that self storage is like any business. Here is our job in self storage:

If you are on a never ending quest to turn assets into more sales, what would that look like?

It might look like always knowing your competition’s pricing so you know exactly when and how much you can increase prices.

It might look like a never-ending inquiry into what other sources of revenues can be generated on your facility. Tenant insurance? Increasing retail? Selling TV’s? Ok, that may be a stretch, but I’ll sell them if people will buy them for more than my cost.

So if you are on a never ending quest to turn sales into more profits, what would that look like?

How can we cut expenses?

Should we use a kiosk instead of a manager in non-peak hours?

How can we keep the same level of customer service and use a kiosk?

And perhaps the most important question, how can we turn profits into more operating cash?

Everyone has heard of Apple, right? The most “profitable” company today. There is also an ongoing conversation about the amount of cash they have at any given moment in time.

Do you know how they answered the question, “how can I turn profit into more operating cash?”

Well, one way is they pay their bills in 60 days. So in other words, in any given month many of their expenses on Scorecard 2 are not paid. The cash you and I would use to pay those expenses shows up on Scorecard 1.

They are big enough to be able to get away with that. Most of us are not a large enough company to make creditors wait for 60 days without incurring more expenses. Which would then affect how much profit we can create from the sales.

Here is what I know now: if we study the scorecards hard enough a story will emerge and we can do something new and different.

That is possible for us now as we begin to translate the weird language of accounting.

After studying this new language, here are a few more observations I have seen. Let me share what I consider the three most important observations of Operating Cash, the most important cash there is:

Observation 1:

This may seem obvious, but Operating Cash should be positive. If your operating cash is negative for long periods of time, that is unsustainable. During growth spurts, operating cash may be negative, but only for a short time. Ongoing that is unsustainable.

If operating cash growth is negative, it means your business is losing money through operations. That also means you have to either dip into savings (Retained Earnings), borrow, sell Things & Stuff, or raise more money from investors to keep going.

If your Operating Cash Flow is negative, you must become very skilled at adjusting the dials and watching the cash. If not, the game is over.

Observation 2:

Operating Cash Flow should be greater that profits. At first, this may not make sense but think about it. Two words, Depreciation and Amortization.

On Scorecard 1 and 2, not all expenses are cash expenses. Depreciation and Amortization reduce profits but never affect cash. That makes Operating Cash Flow smaller than profits.

If you Operating Cash is larger than your profits, look at the Balance Sheet for one or more of the following:

- Balloons in what people owe you (A/R-Accounts Receivable)

- Did you buy inventory such retail items to sell?

- Did A/P, Accounts Payable go way down?

The answer is always on Scorecard 1, the Balance Sheet.

So take these scorecards and begin studying them. You will start to see trends. You will start getting the story of your company in numbers. Patterns will emerge. Then you will begin to know what to do, how to manage your cash, and how this change affects that number.

You take on being a student of the language of business as well as the self storage business. You will in a short time become a force to be reckoned with.

You will be part of the 10% that bucks the statistics and survives through up cycles and down cycles. You will create true Wealth and a fulfilling career in the self storage business.